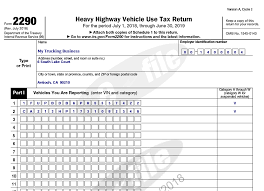

The Heavy Vehicle Use Tax (‘HVUT’) is an annual fee payable to the IRS by all New York truckers owning or operating heavy vehicles with a gross weight exceeding 55,000 pounds which operate on public roads in New York and throughout the US. The taxable weight of a truck is calculated by combining the unloaded weight of the truck together with the maximum load allowed to be carried by the truck and trailer together.

Free to start

Truck Tax is here to help you and some of the common question are answered here